Understanding FDD Item 21: Audited Financial Statements

Reporting obligations of the franchisor

As the end of the FDD creation or reading process nears, it’s natural that all the juicy material is saved for last. That is certainly the case for Item 21, which represents the financial audit of a franchisor’s financial statement reporting obligations.

According to Cheng Cohen Attorney Antonia Scholz, Item 21 requires the franchisor to provide certain minimum financial statements in its FDD. Typically, Item 21 presents audited financial statements of the franchisor; though in some circumstances unaudited financial statements, or parent/affiliate financial statements may be provided.

The following provides a guide of things to look for and precautions to take when working with the Item 21:

Item 21 gives prospective Franchisees a lookback (in most cases 3 years) at the franchisor’s financial condition. In addition to seeing whether the franchisor’s condition has improved over time, the most important element of Item 21 financial statements is simply to understand how the assets and cash flow of the franchisor correspond to the number of franchised units it projects to sell or support. If the franchisor has limited resources and hundreds of Franchisees, it might be a signal that Franchisees will not be receiving much support. In especially dire circumstances, the franchisor may even face liquidation or bankruptcy, leaving its Franchisees with limited options to continue their businesses.

“It is important that before signing a Franchise Agreement, each prospective Franchisee is comfortable that the franchisor is financially sound and able to meet its obligations under the Franchise Agreement,” said Scholz.

Scholz added that Item 21 is significant to Franchisees because it is one of the only FDD disclosures that gives Franchisees meaningful information about the overall financial health and viability of the franchisor. These financial statements are important to the franchisor as well, because it will affect the franchisor’s ability to get registered in many states – whose state examiners will review these financial statements before permitting the franchisor to sell franchises in their state. A franchisor with weak financial statements may be rejected by certain states, or only approved contingent on certain financial safeguards (such as escrowing the initial franchise fees paid by Franchisees with a third-party bank until the franchisor has met its pre-opening obligations).

For franchisee prospects, pay attention to instances where the franchisor also operates a unit-level business (i.e. a company-owned outlet), its financial statements may effectively constitute a financial performance representation. This means that the franchisor must be careful to state that the information disclosed is not a representation of prospective franchisees’ likelihood of success. Watch out for franchisors who earn most of their money from franchise sales. Good franchisors sustain themselves on royalty payments.

“The biggest errors I have seen prospective Franchisees make regarding Item 21 are not reviewing at all (or not understanding what they are looking at), and later being surprised by lack of support or other financial struggles at the franchisor level, or trying to use the data presented in the franchisor’s financial statements to reverse engineer the profitability of franchisor-owned units, which is sure to lead in errors in calculation due to the many variables and complexities that affect the preparation of those financial statements,” said Scholz.

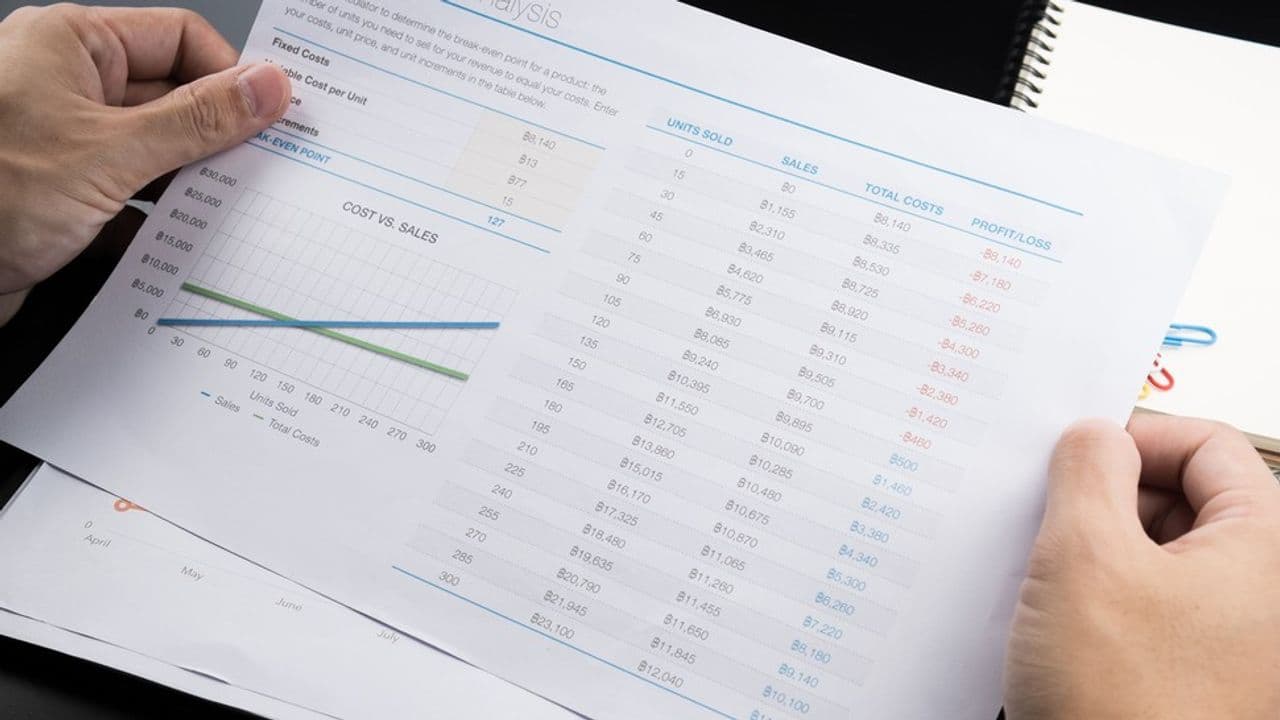

As a franchisee prospect, if all the tables and figures are getting overwhelming, the must-sees are as follows: look at the profit-and-loss statement, then the balance sheet. An accountant may need to assist to determine whether the current ratio of assets to liabilities is favorable and how the franchisor accounts for deferred revenue. Finally, be sure to read the footnotes before moving on to Item 22.

MORE STORIES LIKE THIS

Ideal Siding Founder and CEO Shares His Journey into Franchising

Franchise Deep Dive: QC Kinetix Franchise Costs, Fees, Profit and Data

From Traffic Jam Commuter to Franchisee to Franchisor: The Unconventional Journey of Frios Gourmet Pops’ CEO

Franchise Deep Dive: Renovation Sells Franchise Cost, Fees, Profit and Data