How EZ CERT Became the Certificate Tracking Solution for Franchise Brands

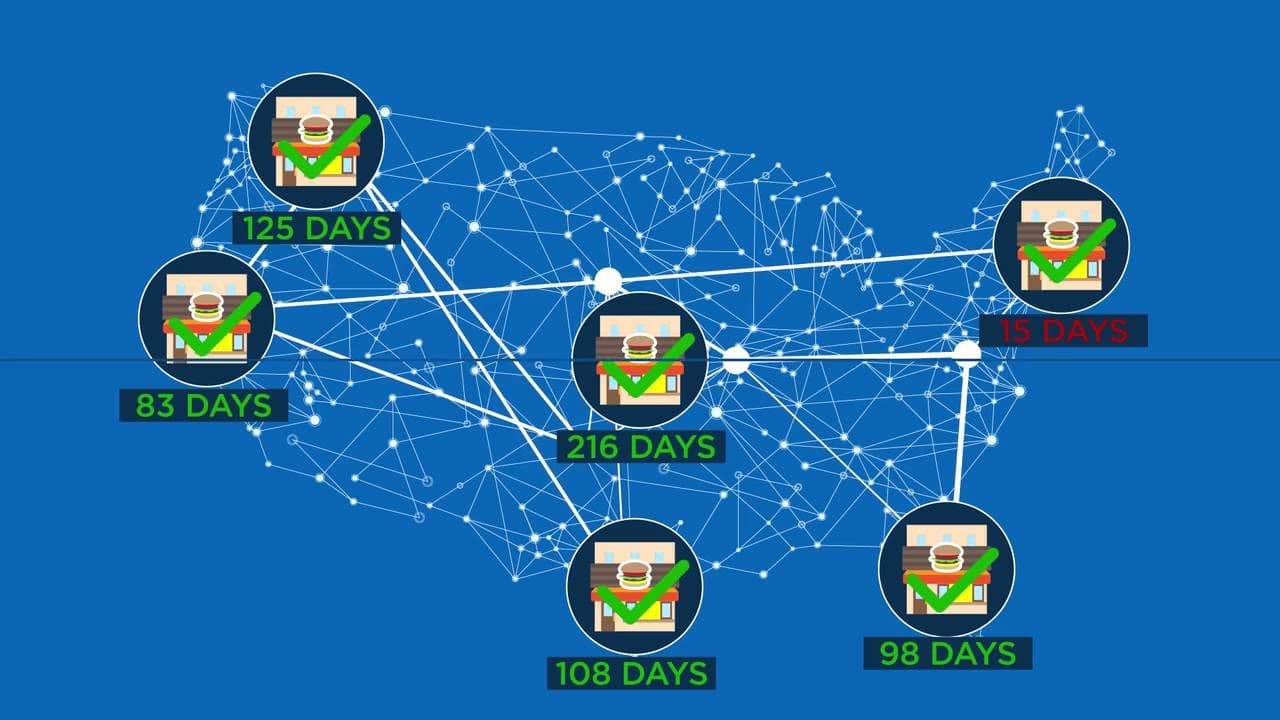

EZ CERT’s team helps brands maintain insurance coverage for every location and compiles reports to effectively track compliance whenever it’s needed.

Whether it’s an emerging concept or a legacy brand, every franchise has to deal with insurance. That’s because a company’s Franchise Disclosure Document requires that all franchises have coverage—if they don’t, it puts both the franchisee and the brand at risk of litigation.

Unfortunately, franchisors, like many businesses, don’t think about insurance until they need it. And by then, it’s usually too late. To help avoid problems before they start, companies like EZ CERT are making it easier than ever before for brands to ensure that their franchisees are in compliance with their FDD. Whether it’s coverages, limits, additional endorsements or any other insurance requirement, EZ CERT helps franchises navigate this complicated landscape.

“Every brand has an FDD that is typically hundreds of pages long. And in that FDD, there are some sort of insurance requirements that a franchisee must carry to operate a location. This can make things complicated—a brand is focused on what it does for living, be it smoothies, haircuts or American fare. They aren’t insurance experts, and they shouldn’t have to be. That’s where EZ CERT comes in to help,” said Doug Groves, principal at EZ CERT. “EZ CERT is an easy way to track, manage and protect your franchise’s insurance compliance with efficiency and effectiveness.

Founded in 2014, the EZ CERT has a team with a combined 50-plus years of insurance experience—including insurance customer service representatives, insurance consultants, insurance agents and multi-franchise area developers. Together, EZ CERT’s team helps brands maintain insurance coverage for every location and compiles reports to effectively track compliance whenever it’s needed. EZ CERT also monitors each location for potential coverage errors and works ahead of the calendar to inform each franchise locations when it’s time to renew.

“Insurance renews for a franchisee every single year. They are free to buy from any agent, and as a result, brands can get overloaded when a franchisee uses multiple agents for the four to five different coverages required,” Groves said. “It’s a lot to keep track of. We’re essentially an extension of the brand, taking care of this often over-looked and misunderstood task.”

Groves added that most franchises aren’t capable of, or would spend capital on, the logging, reading and interpretation of the paperwork. EZ CERT provides a summary report, and they’re able to understand the insurance certificate to correctly interpret the information. The company also knows the requirements of each brand’s FDD, and they’re able to log if a franchisee isn’t meeting the guidelines put in place and outline exactly where they’re falling short. This helps to protect each brand, Groves said, and eliminates risk by ensuring the proper coverage is in place.

“This is a non-revenue generating task for a franchise, but it’s a task that has to be done. EZ CERT exists to act as that safety net and support system—we have the brand’s best interest at heart,” Groves said. “EZ CERT takes this often neglected job and takes care of all the dirty work. This means better, proactive compliance at the hands of dedicated insurance experts.”